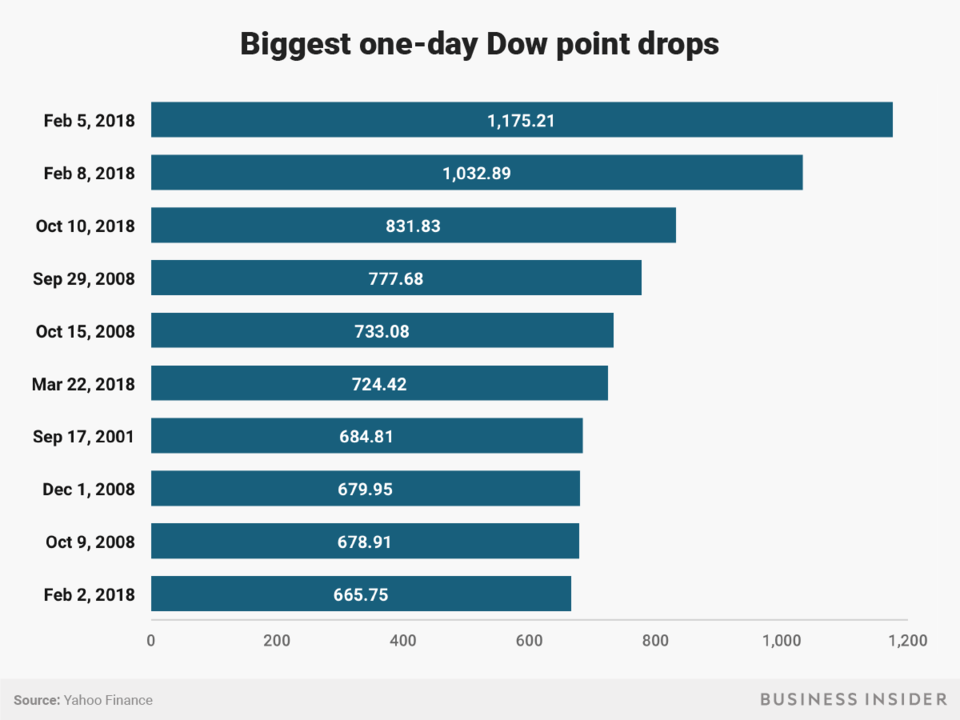

The stock market is once again looking like a roller coaster. With the wild swings in volatility over the past 20 years, you might be asking yourself, “Is the stock market where I want to invest my money?” You’d be right to question whether you want to take this level of risk. Sometimes the stock market can feel like is just one big gamble. Financial Fortress Builders can help teach you more about alternative options that still produce positive returns and without the stress.

Investing Risks

When you put money in the stock market, either by buying individual stocks, ETFs, or mutual funds, you are investing. One thing we should always keep in mind is that all investments have a risk, all of them (the stock market, mutual funds, real estate, metals, business investment, etc.). That means you can lose a little, a lot, or even all of your money in any investment. Risks are commensurate with returns which means the greater the risk, the greater the gains and most importantly, the losses. Is there anything wrong with investing even with that understanding? No. You probably just want to do your investing with money you can afford to lose.

Can you afford to lose any of your retirement money? Let’s hope not. Where is it? Probably in 401k’s, IRA’s or similar retirement accounts. Those are just names for those “accounts”, or a place to put your money, and the money within in them is where? The stock market and/or mutual funds mainly. That means your retirement money, probably your most important money, is 100% at risk, because it is invested.

Regardless of where you put your money, especially your most important money, that for retirement, having a grasp on how money works are essential.

Understanding the Importance of Compounding Interest

Compound interest is where to start to learn about how money works. In simple terms, compound interest is your money earning interest and that money PLUS the interest it earned, is earning more interest. Many people attribute Albert Einstein saying compound interest is the 8th wonder of the world. Whether or not he did make no difference, the fact of the matter is it’ pretty much true. If compound interest is the 8th wonder of the world, that would mean uninterrupted compound interest in the 9th wonder of the world (more on that later).

A Penny Doubled for 31 days

What would you rather have: $1,000,000 today or a penny doubled every day for a month? If you said you will take the $1M today, you are like most people because human nature doesn’t want us to wait. By doing that, you gave up $9,737,418. That is the 8th wonder of the world, compound interest, and the 9th wonder of the world, uninterrupted compounding.

What happens when your compounding is interrupted? Any interruption of your compounding kills you financially. In the above example, we can see our penny doubling each day for a week gives you a whopping $0.64 and after 2 weeks $81.92, big deal. But the process continues and on day 22 you have $20,971.52 and want to use that to buy a car and you do. Your compounding then starts all over and now at the end of the month, you are down to just $2.56.

The taking out $20,971.52 to buy a car is no different than a drop in the stock market, although in this example you have a 100% loss by taking all your money out for your car, which usually doesn’t happen in the stock market in general, but could happen with an individual stock or investment.

There will be ups and downs in the market, that is a given. When your “accounts” have a drop in value, you will probably be advised to keep your money where it’s at because this is for the long term. Yet a smaller interruption in your compounding can still kill you financially and you may not have time to recover. Even if you do, why would you want to go through that?

| Day Number | Amount |

|---|---|

| 1 | $.01 |

| 2 | $.02 |

| 3 | $.04 |

| 4 | $.08 |

| 5 | $.16 |

| 6 | $.32 |

| 7 | $.64 |

| 8 | $1.28 |

| 9 | $2.56 |

| 10 | $5.12 |

| 11 | $10.24 |

| 12 | $20.48 |

| 13 | $40.96 |

| 14 | $81.92 |

| 15 | 163.84 |

| 16 | $327.68 |

| 17 | $655.36 |

| 18 | $1,310.72 |

| 19 | $2,621.44 |

| 20 | $5,242.88 |

| 21 | $10,485.76 |

| 22 | $20,971.52 |

| 23 | $41,943.04 |

| 24 | $83,886.08 |

| 25 | $167,772.16 |

| 26 | $335,544.32 |

| 27 | $671,088.64 |

| 28 | $1,342,177.28 |

| 29 | $2,684,354.56 |

| 30 | $5,368,709.12 |

| 31 | $10,737,418.24 |

Breakeven Percentages For Investments

What if your “account” dropped just 10% in value, what kind of return do you need to get that back? Most people say “10%”. This is where learning about money is important. If you had $100,000 and it dropped 10%, it went to $90,000. A 10% return on $90,000 is $9,000 so you will be at $99,000, not the $100,000 you expected. You would actually need an 11% return. Has the market dropped 10%, 20%, even 50%, yes it has and the chart below will let you see the return you will need for each of those losses…just to get back to even. That is interrupted compounding of your money through market loss, one of the 3 biggest killers of your wealth.

| % Loss To Recover | % Gain Required |

|---|---|

| 10% | 11% |

| 20% | 25% |

| 30% | 43% |

| 40% | 67% |

| 50% | 100% |

| 60% | 150% |

| 70% | 233% |

| 80% | 400% |

| 90% | 900% |

| 100% | YOU'RE BROKE |

Stock Market vs Life Insurance: Who wins?

We have established that all investments have risk, that your most important money is probably being invested and at risk, how compound interest works and having it uninterrupted is how you want your money to grow. Uninterrupted means no loss and no loss means guarantees and that is what safe money strategies help you obtain.

The tortoise beat the hare. Slow continual growth of your money, in a safe vehicle, is an option to be looked into, regardless if you were to move forward with something like that or not.